- Services

- ConsultantsMODULESLegacy Support

- Industries

- Locations

WESTERN & NORTHERN EUROPE

EASTERN & CENTRAL EUROPE

- Our Company

About Us

About UsLearn more about our HireDynamicsDevelopers portal and the team behind it.

Case StudiesRead successful stories from our clients across various industries.

ServicesFind the right service according to your specific business needs.

- Services

- ConsultantsMODULESLegacy Support

- Industries

- Locations

WESTERN & NORTHERN EUROPE

EASTERN & CENTRAL EUROPE

- Our Company

About Us

About UsLearn more about our HireDynamicsDevelopers portal and the team behind it.

Case StudiesRead successful stories from our clients across various industries.

ServicesFind the right service according to your specific business needs.

5 Dynamics 365 Plugin Development Best Practices

Updated: October 14th, 2025 by Ivan Farafonov

Microsoft Dynamics 365 provides businesses with a robust platform to streamline processes and enhance efficiency. One of the standout features is dynamics 365 plugin development, which tailor the system to meet specific business needs. These customizations not only optimize Dynamics 365’s functionality but also demonstrate the platform’s versatility in addressing industry-specific challenges.

This article explores key best practices for plugin development in dynamics 365, focusing on real-world examples and applications across various business modules.

1. Comprehensive Validation with PreValidation Plugins

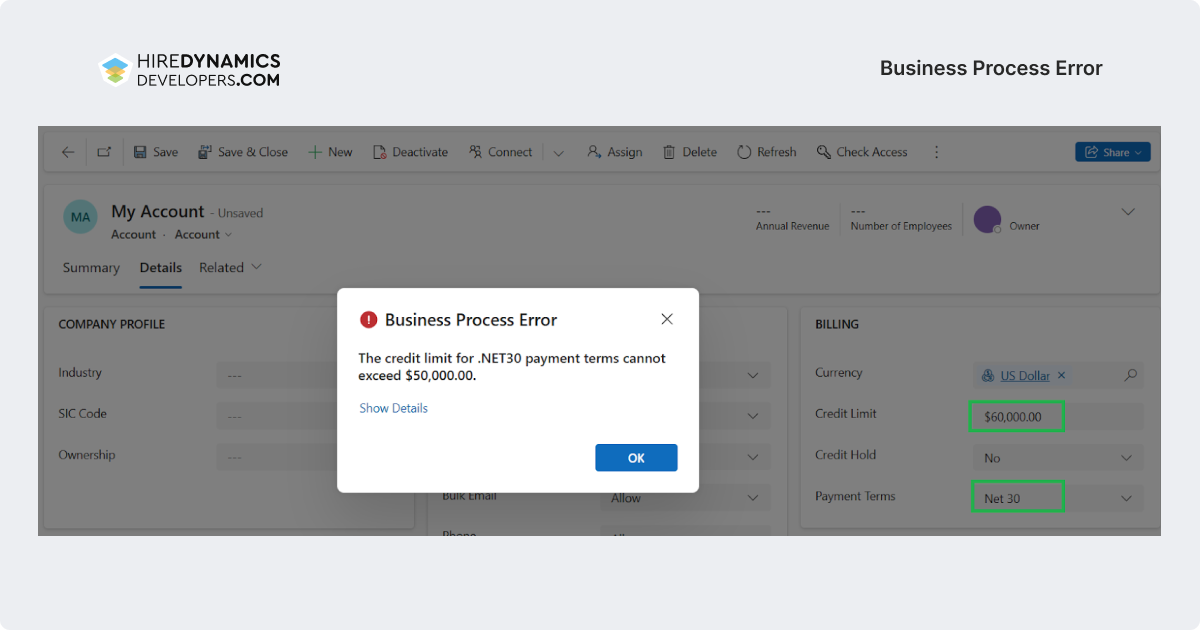

Scenario: Enforcing Credit Limits Based on Payment Terms

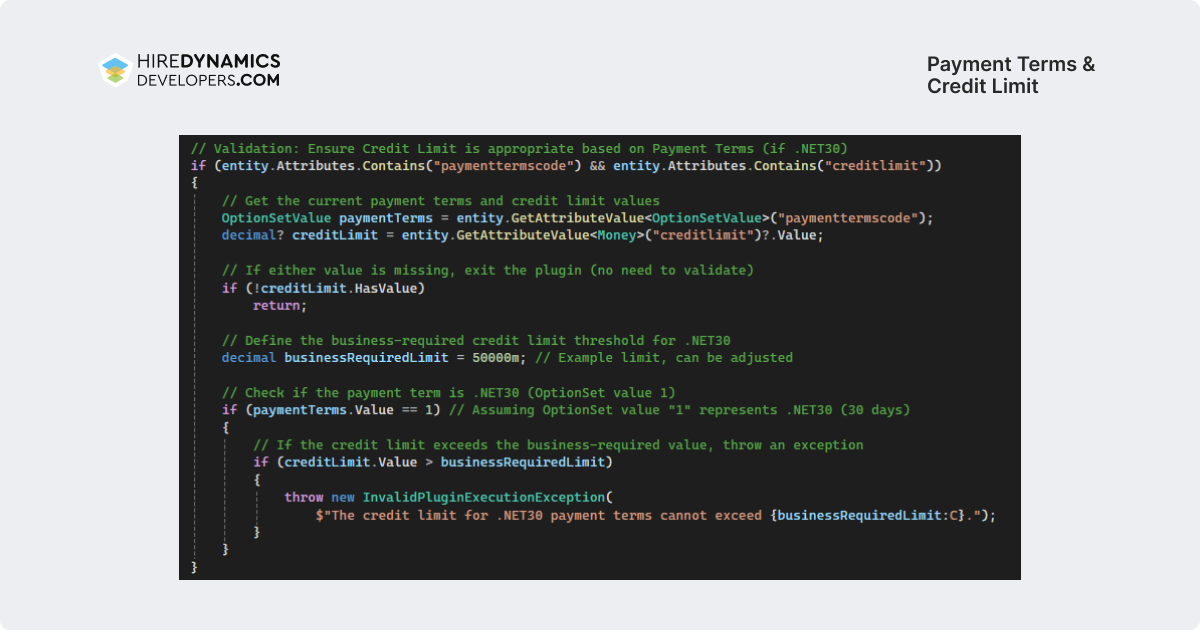

A business might need to enforce strict credit policies, such as limiting credit for accounts with short payment periods. For example, accounts using .NET30 payment terms (30-day payment cycles) may have a credit limit cap of $50,000.

How It Works:

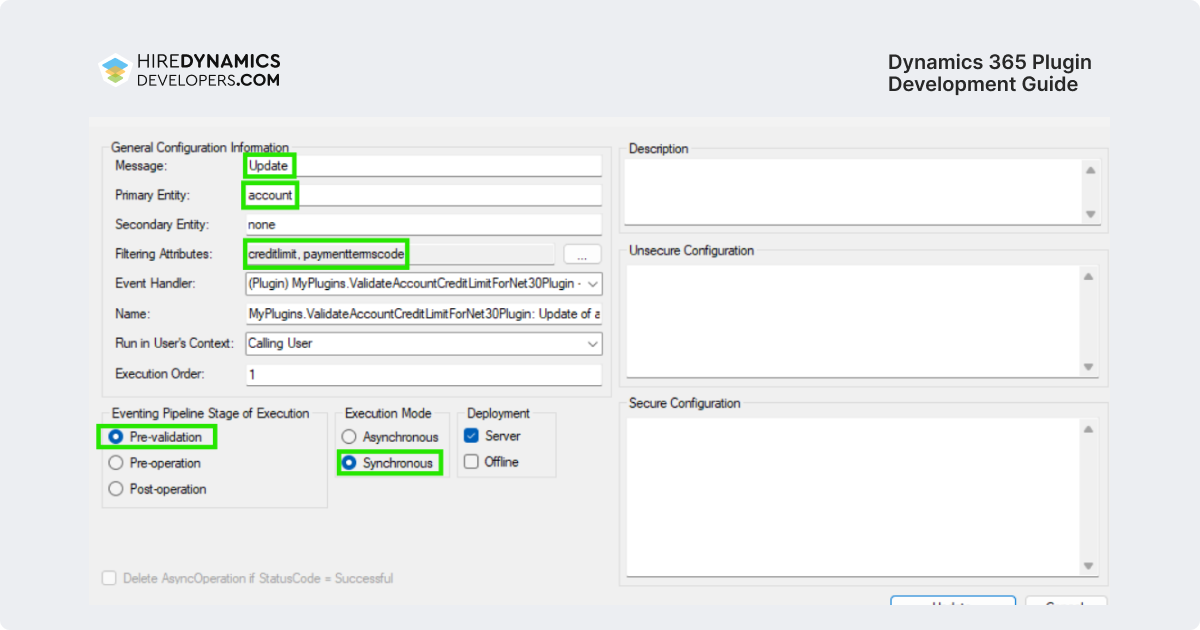

A plugin triggers during the PreValidation phase of the Update event, ensuring compliance before database changes. The plugin performs validation, and blocks updates if limits are exceeded.

Simple Dynamics 365 plugin development guide:

- Ensure the plugin runs for account records in the Update event.

- Retrieve the Payment Terms (e.g., .NET30) and Credit Limit.

- If the Payment Terms is .NET30, compare the Credit Limit to the business-defined threshold (e.g., $50,000).

- If the Credit Limit exceeds the threshold, throw an error to prevent saving the record.

This scenario is relatively simple, as it assumes that both fields being validated—Payment Terms and Credit Limit—are updated simultaneously. In real-world scenarios, however, it’s possible for only one field to be updated at a time. In such cases, retrieving unchanged field values for validation is crucial. See Practice 2 for an example where PreImage is particularly beneficial in handling this situation efficiently.

Industries: Finance, Retail, and Manufacturing.

Required Specialist: Developer with expertise in Dynamics 365 and plugin registration.

Benefits:

- Risk Management: Prevents accounts with short payment periods from exceeding credit limits, reducing financial risk.

- Data Integrity: Ensures compliance with credit policies before updates are committed to the system.

- Efficiency: Automates credit validation, minimizing manual intervention and potential errors.

Hire our Dynamics 365 consultants if you need help with plugin development!

2. Utilizing PreImage for Efficient Logic Handling

Scenario: Validating Dependent Field Updates

Consider a scenario where a user updates only one field (e.g., Credit Limit) on an account, while the plugin logic requires values from another field (e.g., Payment Terms) to complete validation. For example, if Payment Terms is set to .NET30, a Credit Limit exceeding $50,000 should trigger a validation error, even if the Payment Terms field isn’t part of the current update.

How It Works:

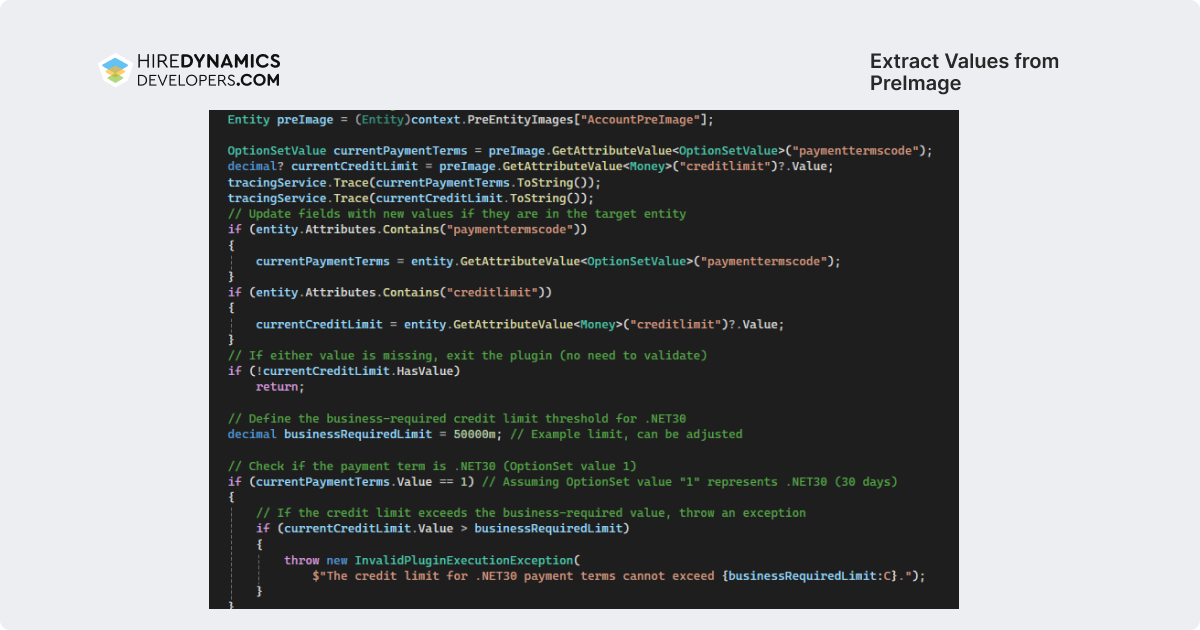

The plugin uses a PreImage to retrieve the current value of the Payment Terms field during the update process, ensuring all necessary data is available for validation. By avoiding additional database calls, the plugin maintains performance and reliability.

How to use PreImage for dynamics plugin development:

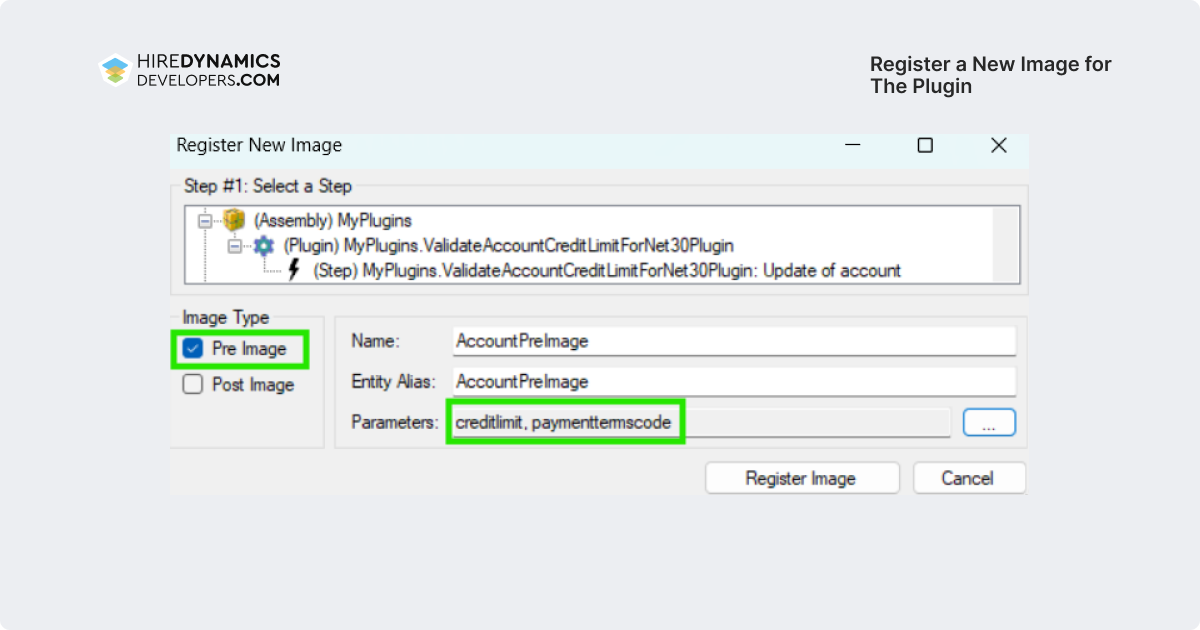

- Register a new Image for the plugin step.

- Extract values from PreImage by code.

PreImage is particularly advantageous when handling scenarios where updates to multiple dependent fields may not occur simultaneously. This allows businesses to enforce complex rules without burdening the database with extra retrieval queries.

Industries: B2B Sales, Wholesale, and Distribution.

Required Specialist: Dynamics 365 Consultant or Developer.

Benefits:

- Performance Optimization: Reduces database load by using PreImage for existing data.

- Consistency: Maintains uniform logic across records for accurate decision-making.

- Cost Savings: Minimizes resource consumption, leading to lower operational costs.

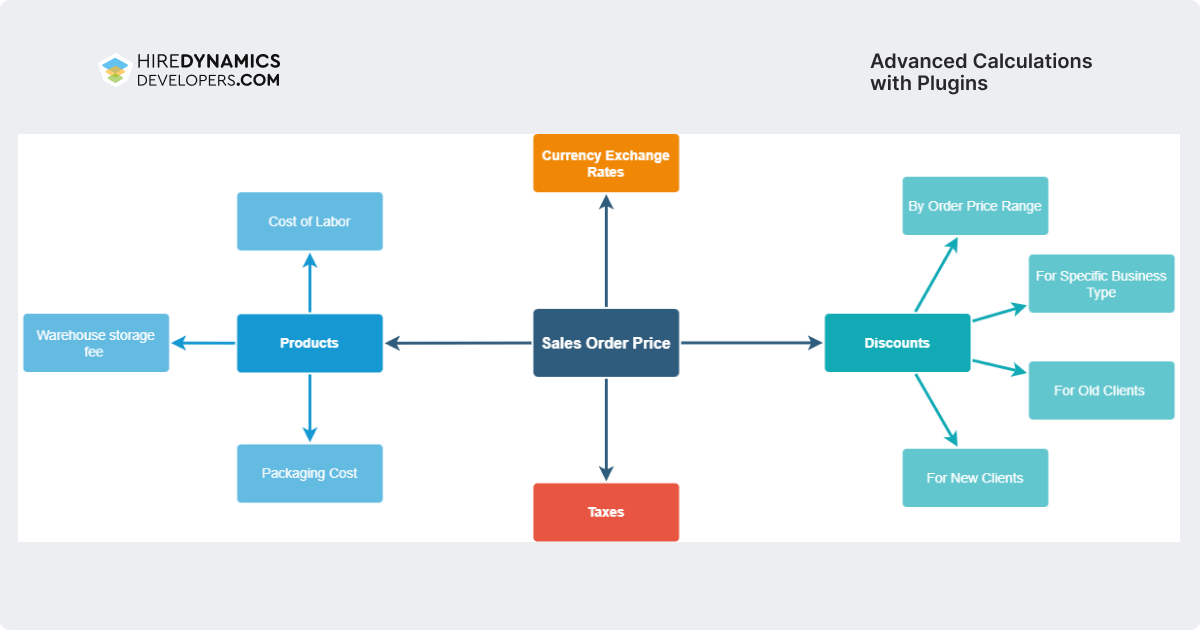

3. Advanced Calculations with Plugins

Scenario: Automating Price Adjustments Based on Multiple Variables

Dynamic pricing might rely on factors like product category, volume discounts, and customer tiers. For example, a business could calculate a final price using a weighted formula involving these factors.

How It Works:

A plugin triggers during a calculation event, processes input values, and updates fields with the final price. This can be visualized using a diagram illustrating the flow of input data through the formula.

Industries: E-commerce, Manufacturing, and Logistics.

Required Specialist: Dynamics 365 Consultant or Developer.

Benefits:

- Scalability: Supports complex pricing logic across multiple products and services.

- Accuracy: Automates calculations to eliminate manual errors.

- Customer Satisfaction: Provides consistent pricing aligned with business policies.

4. Logic for External Data Verification

Scenario: Matching Imported Leads with Existing Accounts

When importing leads, it is essential to identify potential matches with existing accounts based on criteria such as email domain or company name.

How It Works:

A plugin triggers during the data import process, compares imported data with existing records, and either associates or flags discrepancies for manual review.

Industries: Marketing and Customer Service.

Required Specialist: Dynamics 365 Consultant or Data Analyst.

Benefits:

- Improved Data Quality: Reduces duplicate records by verifying matches during import.

- Operational Efficiency: Automates matching, saving time on manual reconciliation.

- Enhanced Reporting: Provides accurate and complete datasets for analysis.

Our Successful Case Study

- USA

- Financial Services

- Part-time (30-40 hrs/week)

- 3 Full-Stack Developers 1 Full-Stack Team Lead 1 Technical Interviewing Expert

- Dynamics 365 Finance and Operations

Our client is a successful US-based financial company that offers life insurance products, retirement savings programs, and unique benefits for members of all ages. It was founded as a non-profit organization to provide its members with financial security and social engagement. Due to the expansion, the company needed to streamline its workflows with a powerful system that would collect all the necessary information. That’s why the team turned to us.

After clarifying all the contract and software issues, we assembled a team to implement Dynamics Finance and Operations. The client also decided to use our technical interviewing services to help build a skilled and experienced team. We filled the technical interviewer position quickly and then found a Team Lead and 3 Microsoft Dynamics Developers.

The experts quickly agreed on the client’s vision and customized the module. It resulted in a significant increase in the client’s revenue and allowed them to direct investments and efforts to strategic tasks.

5. Custom Solution for Complex Business Requirements

Scenario: Calculating Tax Rates Based on Jurisdiction

Tax compliance for businesses operating across multiple regions can be complex. A plugin automates tax rate application based on the customer’s location and jurisdiction rules.

How It Works:

When an order is created, the plugin determines the applicable tax rate, calculates the total tax.

Key Points:

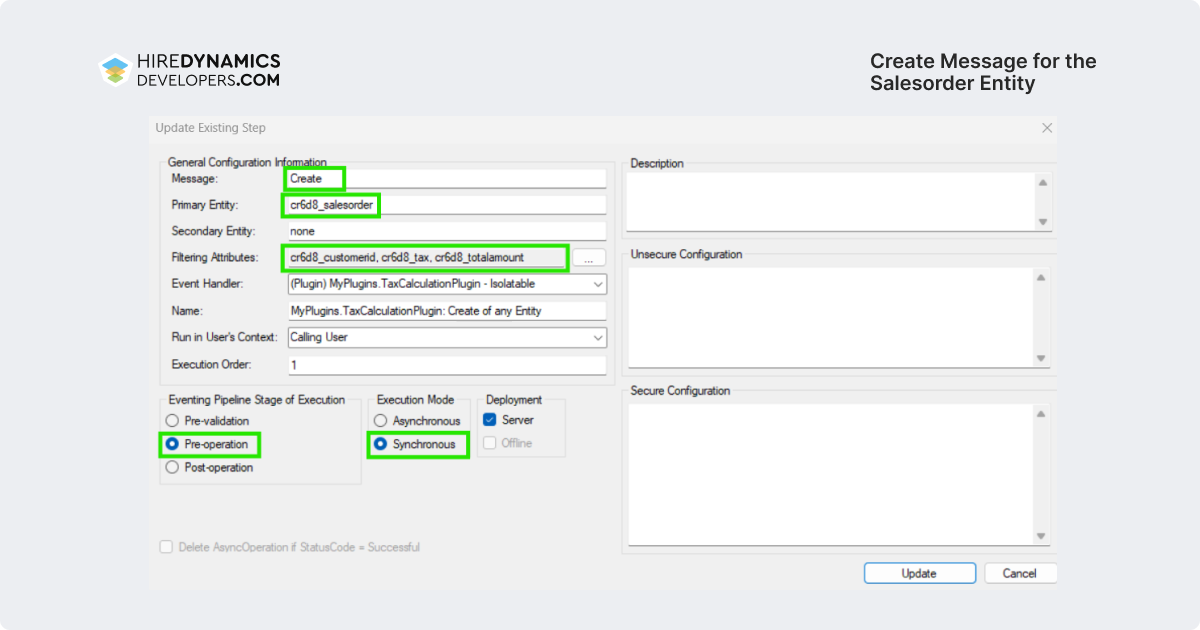

- Trigger: This plugin runs when a salesorder entity is created. It is triggered by the create message for the salesorder entity.

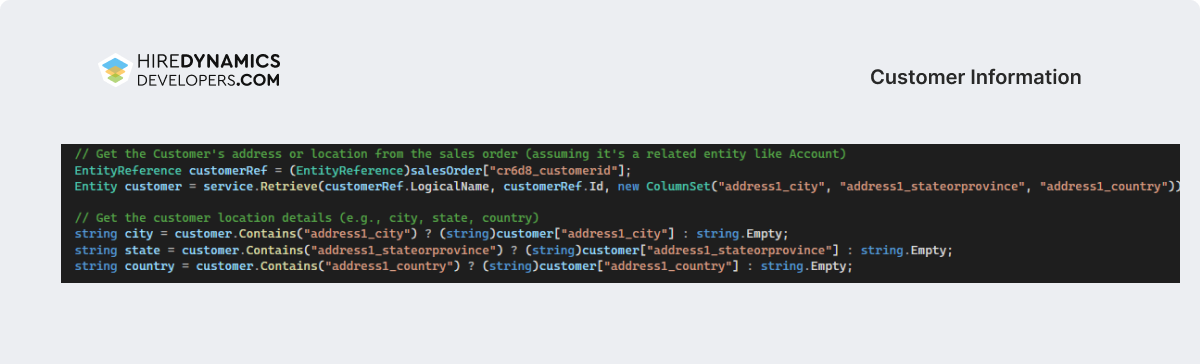

- Customer Information: The plugin fetches the customerid (Account) from the order and retrieves the customer’s address information (city, state, and country).

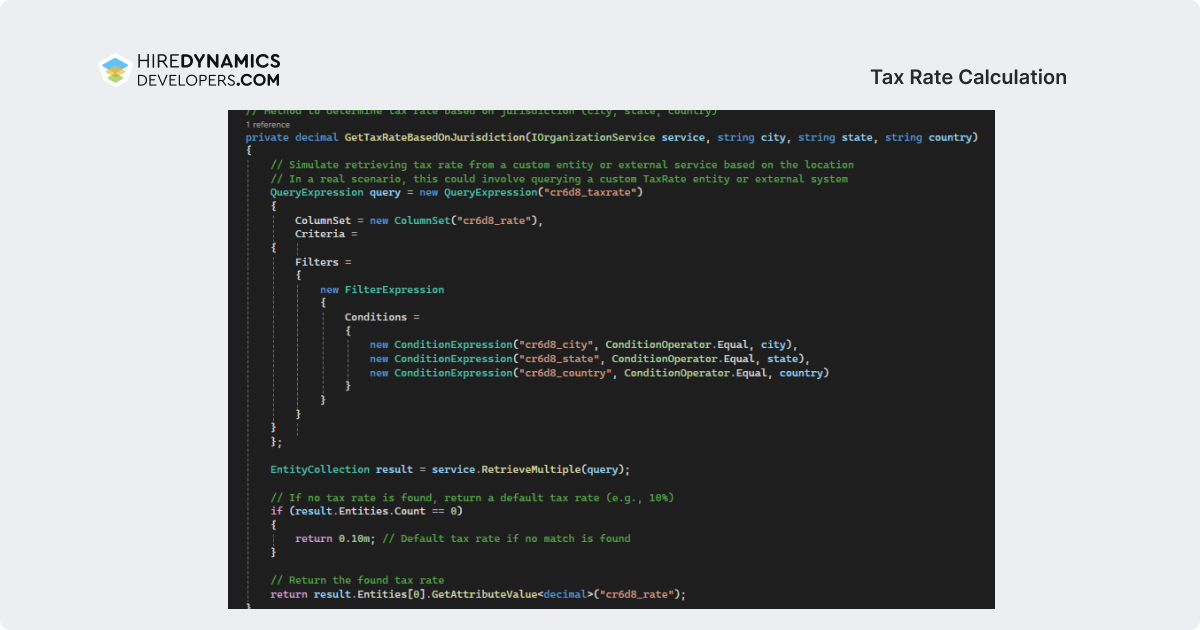

- Tax Rate Calculation: The GetTaxRateBasedOnJurisdiction method looks up the applicable tax rate for the customer’s location (city, state, country) from a custom taxrate entity in CRM. You can extend this logic to use a more complex or external tax calculation system if needed.

- Tax Calculation: It calculates the total tax based on the order’s totalamount and the retrieved tax rate.

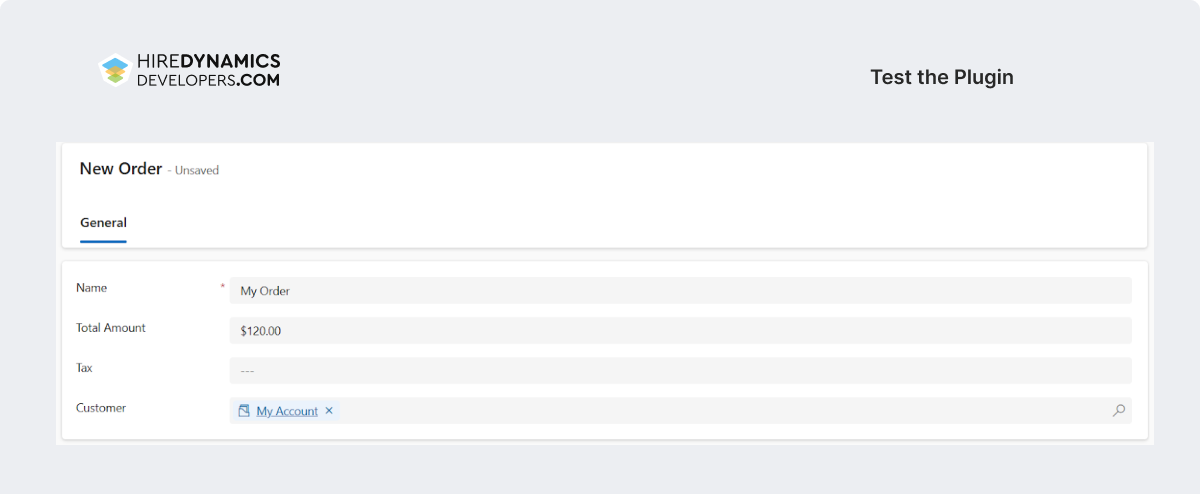

Let’s try to create a new order and test the plugin.

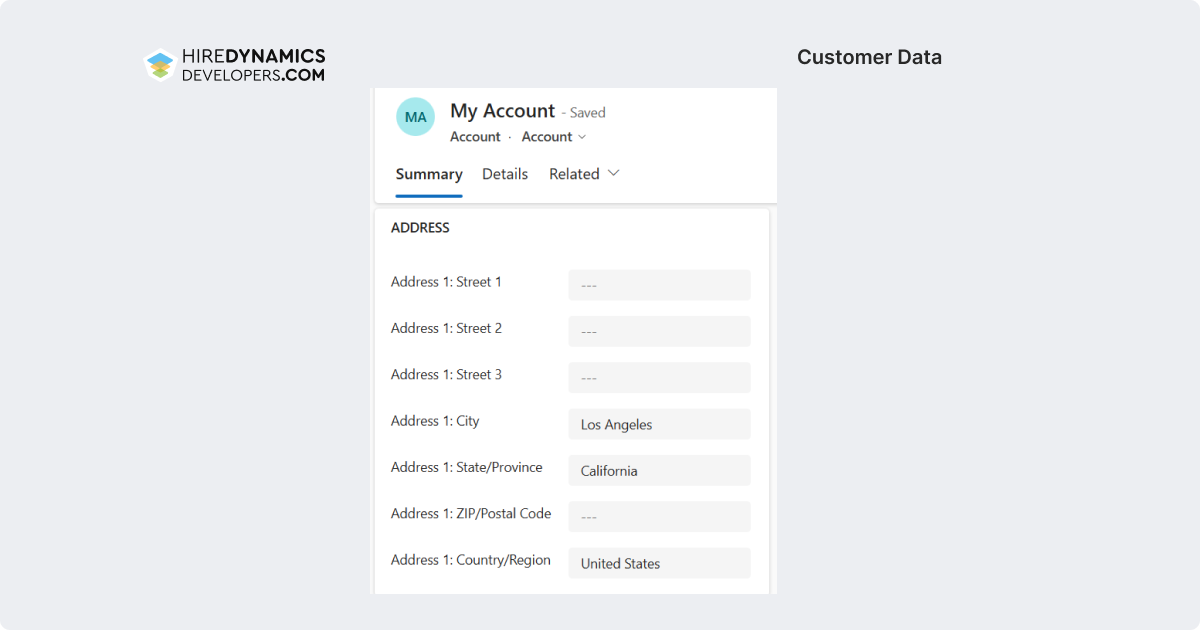

Customer data:

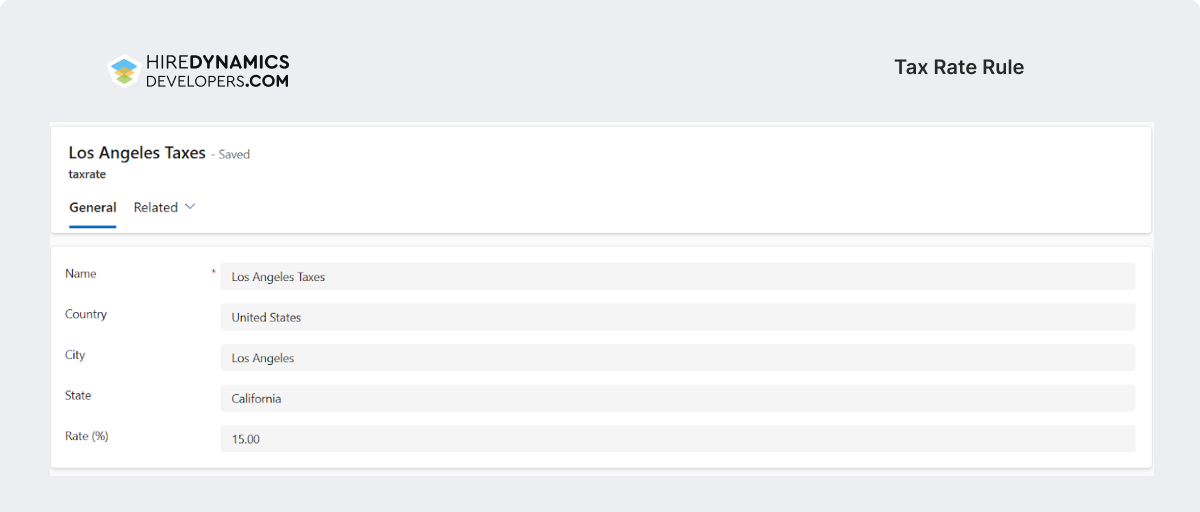

Tax Rate rule:

Industries: Retail, E-commerce, and Professional Services.

Required Specialist: Dynamics 365 Developer (and Tax Consultant for this specific scenario).

Benefits:

- Regulatory Compliance: Ensures accurate tax calculations based on local laws.

- Efficiency: Automates complex tax logic for quicker order processing.

- Customer Trust: Provides accurate billing, improving customer confidence.

Tips for The Best Microsoft Dynamics 365 Plugin Development

There are some useful tips for the best microsoft dynamics 365 plugin development:

1. Keep Plugins Lightweight

- Plugins should only perform necessary tasks. Avoid long-running or heavy computations inside the plugin, as it can impact performance and lead to timeouts.

- Use external systems for complex logic (e.g., background services or external APIs) when applicable.

2. Minimize Data Retrieval and Writes

- Avoid excessive data retrieval and updates. Query only the fields you need, and minimize unnecessary writes to the database.

- If possible, use RetrieveMultiple to get related records instead of making individual calls for each record.

3. Handle Exceptions Gracefully

- Always handle exceptions and throw meaningful messages. This is especially useful for debugging and troubleshooting.

- Use custom error handling to provide context about what part of the process failed.

4. Minimize the Scope of Plugins

- Register plugins for specific actions (e.g., Create, Update, Delete, SetState, etc.) and avoid triggering them unnecessarily.

- Use filtering attributes in plugin registration to ensure that plugins only run when specific fields or conditions change (e.g., trigger the plugin only if the statuscode field changes).

5. Use Asynchronous Plugins for Long-Running Operations

- If the plugin performs long-running or resource-intensive tasks (such as sending emails, calling external APIs, etc.), register it as asynchronous.

- This avoids blocking the user’s actions and improves overall performance, as the task will run in the background.

6. Use Proper Error Handling and Logging

- Implement robust error handling using try-catch blocks. Log errors to an external logging system or create custom error logging entities in CRM for later troubleshooting.

- Use TracingService to log important information and errors during the plugin execution. This is helpful for debugging, especially in production environments.

Are you looking to develop a new plugin for Dynamics 365?

Contact us to find a reliable Dynamics consultant for professional assistance!

Conclusion

Dynamics 365 plugin development offers unparalleled opportunities to enhance system capabilities and meet specific business needs. From enforcing compliance to automating complex calculations and integrating with third-party systems, plugins empower businesses to optimize operations and drive efficiency.

By adhering to Dynamics 365 plugin development best practices such as using appropriate event phases, leveraging PreImage for data handling, and selecting the correct execution type, businesses can achieve long-term success with Dynamics 365.

Outline

Dragos S.

20 Hours / Week

Ihor K.

20 Hours / Week

Anastasia V.

40 Hours / Week

Request Our Services

Improve Your Dynamics Environment with Plugin Development Guide!

Your Partner Recognized in Dynamics Community