- Our Models

- ServicesHesitant in service?

Get in touch with us with your business problem and we’ll consult you on the suitable service solution.

- SolutionsApplicationsLegacy SupportOther Microsoft SolutionsPower Platform ConsultantsAzure ConsultantsAzure Developers

- Industries

- Our Company

About Us

About UsLearn more about our HireDynamicsDevelopers portal and the team behind it.

Case StudiesRead successful stories from our clients across various industries.

ServicesFind the right service according to your specific business needs.

- Resources

- Our Models

- ServicesHesitant in service?

Get in touch with us with your business problem and we’ll consult you on the suitable service solution.

- SolutionsApplicationsLegacy SupportOther Microsoft SolutionsPower Platform ConsultantsAzure ConsultantsAzure Developers

- Industries

- Our Company

About Us

About UsLearn more about our HireDynamicsDevelopers portal and the team behind it.

Case StudiesRead successful stories from our clients across various industries.

ServicesFind the right service according to your specific business needs.

- Resources

Tax Calculation and Management with Dynamics 365 Finance and Operations

Updated: December 18th, 2024 by Ivan Farafonov

Dealing with taxes is a complex process, especially if you’re not familiar with technical intricacies. Calculation is not a highly popular focus for most people, but it is a critical aspect of any business. Moreover, it should be compliant to ensure continued financial operations.

Microsoft with Dynamics 365 Finance and Operations offers a robust and flexible calculation engine. It helps automate and simplify the determination and calculation process. However, dealing with the complex system may be challenging, especially for newbies.

This article provides a tax calculation overview and explores the capabilities of Dynamics 365 Finance and Operations. We find out platform benefits and discover elements that can be configured:

- Sales Tax code

- Item Sales tax code

- Tax applicability matrix

- Tax calculation formula.

Benefits of Tax Calculation with Dynamics 365 Finance and Operations

Dynamics 365 F&O tax calculation has many advantages. First of all, the system simplifies and reduces manual work. This allows you to relieve your specialists and direct their time to more critical tasks. Secondly, this approach to tariff management significantly increases the accuracy of reports. The software uses the information you already have and calculates everything accurately according to a formula. This approach eliminates the human factor and manual errors. Finally, with Tax Calculation Service (TCS), you make your business process on a global scale more efficient. Thus, all operations are more efficient.

Let’s look at more benefits:

Ease of Use

Dynamics 365 Tax Calculation Module has a user-friendly interface. This way, each tool is easy to understand and does not require deep technical knowledge.

Compliance with Tax Regulations

Dynamics 365 Finance and Operations keeps up-to-date with local and international regulations, whether it is VAT or GST. It ensures that your company stays compliant without penalties and fines due to errors or outdated rules.

Real-Time Insights

The platform provides real-time insights. Based on the data, you may track cash flow management and financial planning.

Multi-Currency and Multi-Language Support

The tax calculation system has built-in multi-currency and multi-language support. It simplifies the process for businesses operating in multiple countries. In addition, this feature ensures an accurate tax calculation process regardless of the region or currency.

Accuracy and Reduced Errors

By automating complex operations, you minimize the potential for human errors. This accuracy helps avoid costly mistakes and maintain high-quality financial records.

Configurable Tax Calculation Rules

The finance and Operations module allows set up rules and rates according to your specific needs. This way, all orientations adapt to company policies and regional laws.

Implement the Dynamics 365 Finance and Operations module with our experts!

Tax Configuration and Setup

Before taxes can be calculated automatically, you must configure your codes, jurisdictions, and relevant rules in D365 F&O.

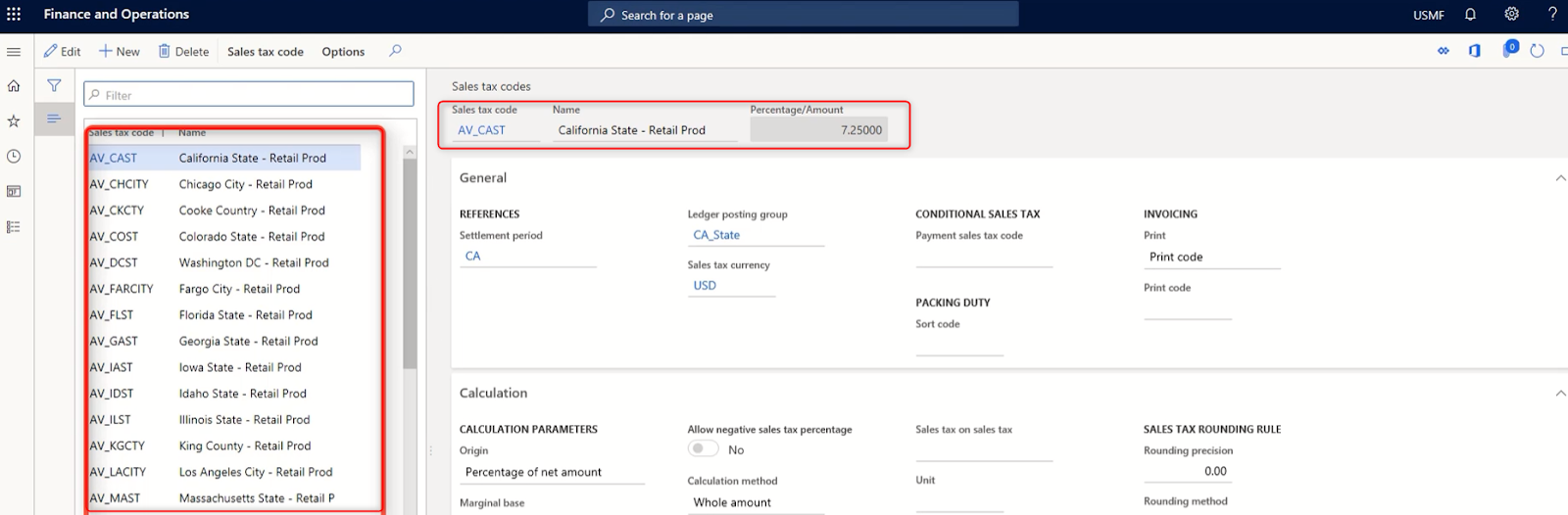

Step 1: Define Sales Codes

Tax codes are the foundation of management in D365 F&O. These codes represent specific rates and are applied to transactions based on regional rules.

- Go to Tax > Indirect Taxes > Sales Tax > Sales Tax Codes.

- Select New to create a new code.

- Define the Sales Tax Code, the Percentage, and the Sales Tax Authority responsible for collecting the tariffs.

The code is a part of the setup of fees. Codes specify the following parameters:

- How to calculate

- The value to use for calculation

The value is important because no tariff is calculated without it.

In the configuration window, you can define various parameters like rate percentage, calculation method (marginal, interval, or percentage), and validity periods.

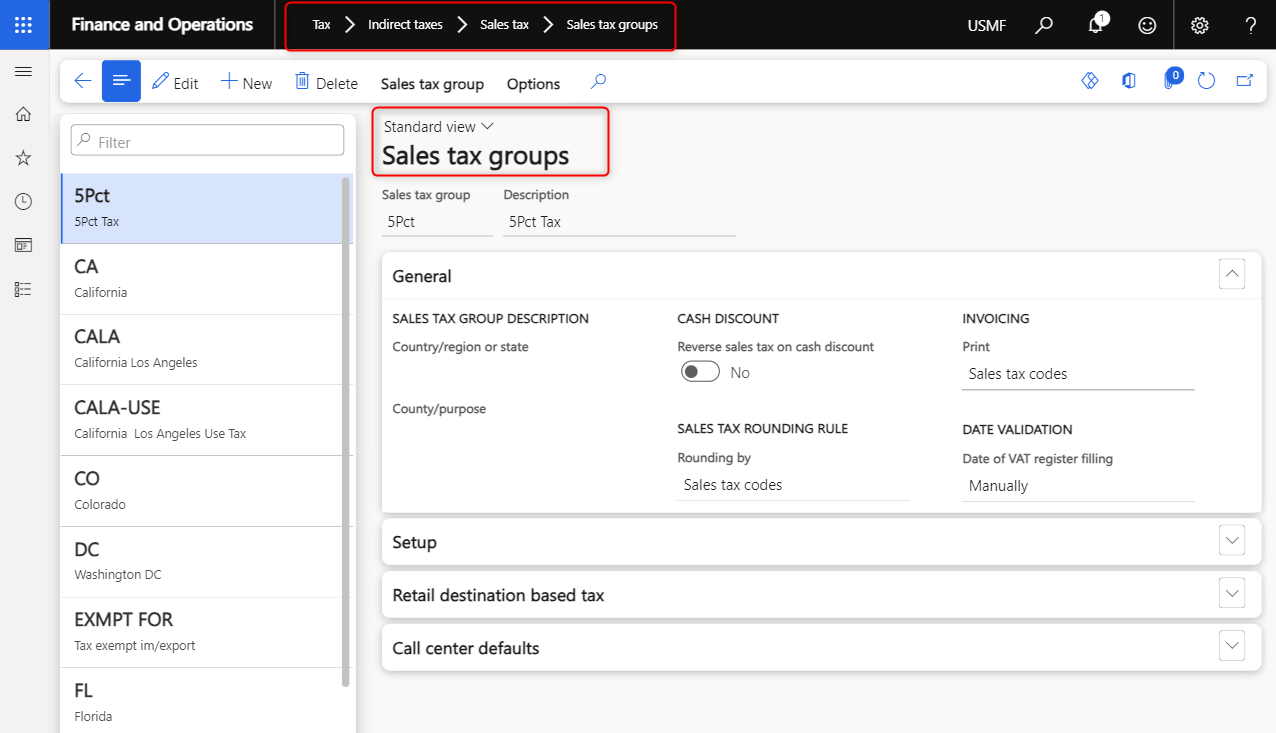

Step 2: Configure Sales Tax Groups and Item Sales Tax Groups

Sales groups are collections of codes linked to customers, vendors, and certain ledger accounts. They include all the tax codes needed for trading goods or services with customers and vendors.

- Go to Tax > Indirect taxes > Sales tax > Sales tax groups

- Select New on the Action Pane

- In the Sales tax group field, enter a value

- Enter a value

- Expand the Setup section

- Select Add

- In the Sales tax code field, select the dropdown button to open the lookup

- Select Save

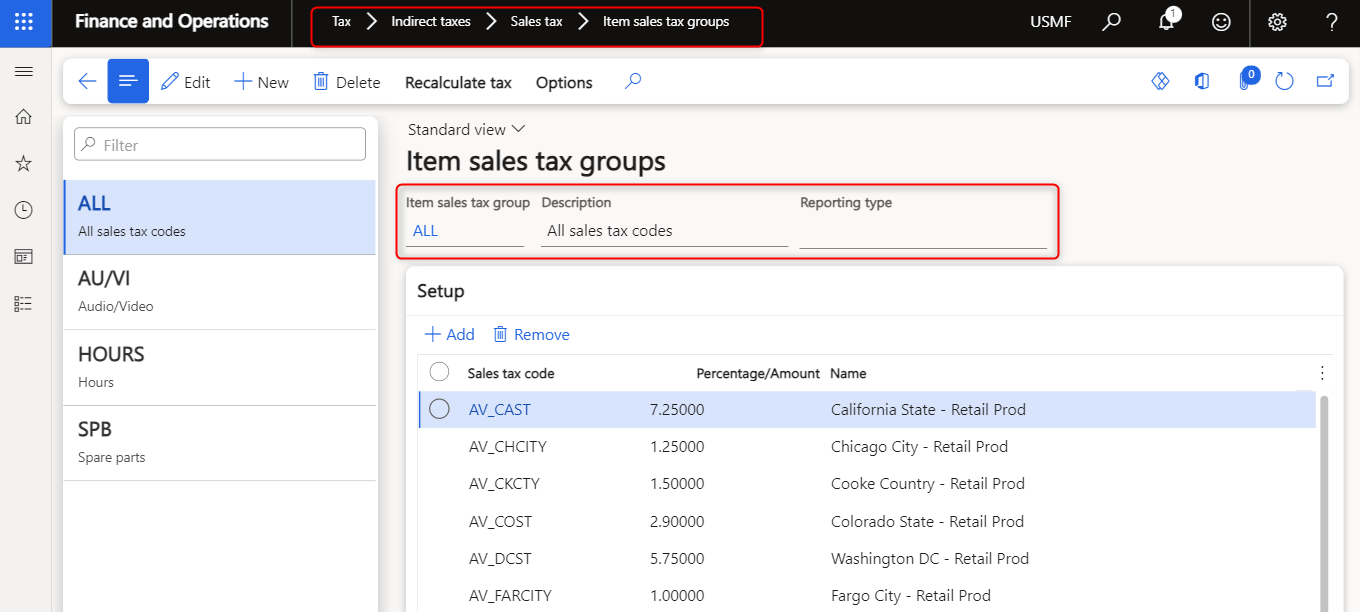

Step 3: Item Sales Tax Groups

Because items generally determine fees, you need to indicate how to calculate taxes for each item. Item tax groups are groups of tax codes that are attached to resources, such as products.

Every transaction for which you need to calculate post-sales tax must have a group and an item tax group.

- Go to Tax > Indirect taxes > Sales tax > Item sales tax groups

- Select New

- In the Item sales tax group field, enter a value

- In the Description field, enter a value

- Select Add

- Select the dropdown button to open the lookup

- Select Save

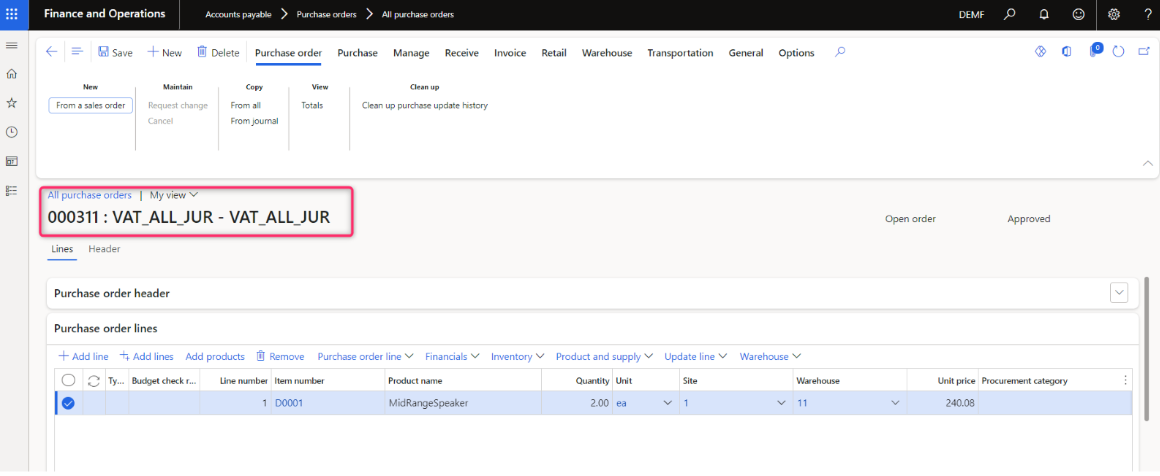

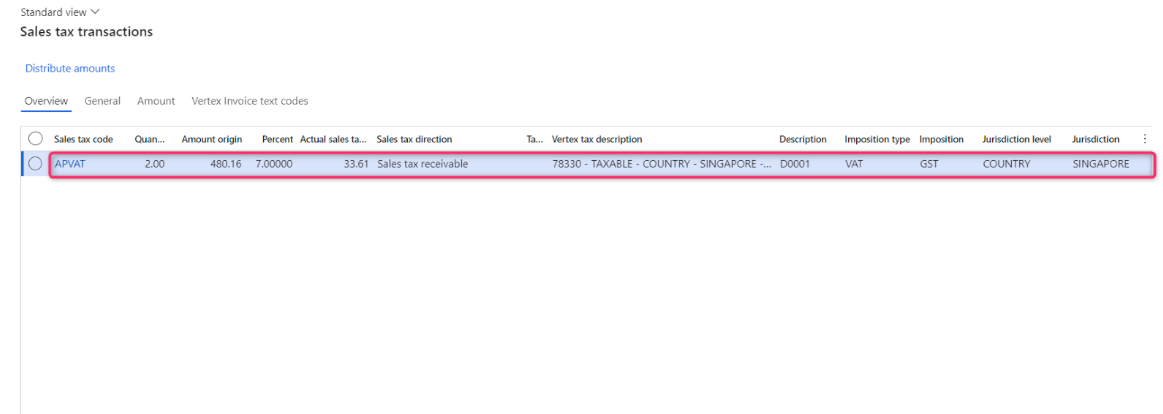

Let's Practice and Create a Purchase Order

When you create a Purchase order, the form type, the group, and the item group are displayed in the line details of the order line. The type and groups are based on the values that are attached to the Purchase order.

Here’s setup for an example:

- Name Sales tax code: APVAT

- Tax Rate: 7%

- Jurisdiction: Singapore

Once created, this code can be associated with transactions such as orders, purchase orders, or other financial entries.

- Click Accounts payable > Purchase orders > All purchase orders

- Create a New Purchase order

- Specify Sales tax groups and Item Sales group

- Add Item

5. Press Sales tax

As you can see, the system automatically calculates fees. If you want to simplify the process, consider cooperating with an MS Dynamics implementation expert.

Need Help Setting up Tax Calculations?

Although tax calculation with Dynamics 365 Finance and Operations is a simple and time-saving process, it can be difficult to set up the system. All features must be customized to your needs to ensure a high-quality experience without interruptions and bugs. In addition, tax calculation in Dynamics 365 requires integration with other systems to obtain all the necessary data. Of course, this requires knowledge and skills not only in the FO module but also in the entire Microsoft environment. This is where we can help!

We have an extensive database of experts and are ready to connect you with a highly qualified Dynamics 365 F&O developer. With a team of professionals on your side, you’ll be able to complete your tasks much faster and get a better result. Let’s see why this is beneficial.

- We offer cost-effective cooperation. We have an extensive database of experts and can find professionals at affordable rates. In addition, we offer an offshoring model. Yes, you can hire specialists from other countries: this allows you to save money without compromising the result.

- The next is flexibility. We offer different models of cooperation so that everyone can choose the right option. For example, we can create a full-fledged development team for you, find a part-time consultant, or provide technical interview services and test the skills of your candidates.

- Last but not least, quality is important. We are focused on high-quality results, so we offer only qualified developers who work for results.

Some of Our Dynamice Experts

Conclusion

To sum up, Dynamics 365 Finance and Operations tax calculation and management is a powerful and user-friendly solution for managing fees. It automates and simplifies all reporting processes, ensures compliance, saves time, and reduces errors.

The flexibility of D365 Finance and Operations makes it a great choice for companies that operate in multiple jurisdictions or deal with different types of tariffs. Whether you are a small company paying locally or a multinational corporation dealing with the complexities associated with multiple jurisdictions, D365 Finance and Operations can be tailored to your specific needs.

Are you looking for assistance with tax calculation?

Get in touch with us to hire Finance & Operations expert!

Outline

Arvid O.

20 HOURS / WEEK

Artem A.

20 HOURS / WEEK

Alejandro G. T.

30 HOURS / WEEK

Request Our Services

Improve Your Tax Calculation and Management with Dynamics 365 Finance and Operations!

Your Partner Recognized in Dynamics Community